And they have progressively moved away from their original goal of decentralisation to increasingly rely on centralised solutions and market structures. Unbacked cryptos have made no inroads into the conventional role of money. However, this narrative often obfuscates reality. This would in turn make it possible for money and finance to operate without trusted intermediaries.

#Crypto compare market caps free#

The core promise of cryptos is to replace trust with technology, contending that the concept “code is law” will allow a self-policing system to emerge, free of human judgement and error.

Shifting narratives: from decentralised payments to centralised gambling This may prompt the ecosystem to make more effort to provide genuine value in the field of digital finance. Instead, regulators should subject cryptos to rigorous regulatory standards, address their social cost, and treat unsound crypto models for what they truly are: a form of gambling. Policymakers should be wary of supporting an industry that has so far produced no societal benefits and is increasingly trying to integrate into the traditional financial system, both to acquire legitimacy as part of that system and to piggyback on it.

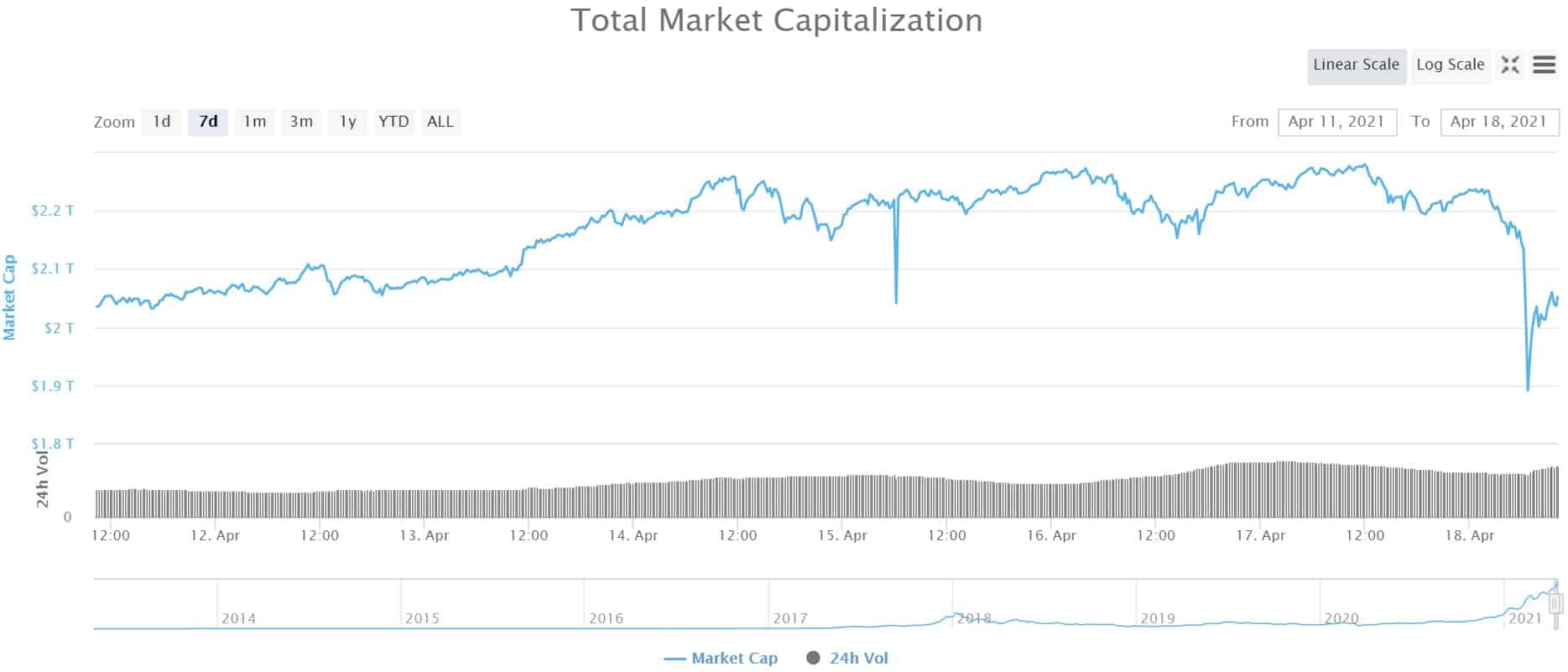

The crypto ecosystem is riddled with market failures and negative externalities, and it is bound to experience further market disruptions unless proper regulatory safeguards are put in place. Today I will contend that due to their limitations, cryptos have not developed into a form of finance that is innovative and robust, but have instead morphed into one that is deleterious. The recent developments that have affected leading crypto-asset exchanges have highlighted the contradictions of a system which, though created to counteract the centralisation of the financial system, has become highly centralised itself. This makes them particularly sensitive to changes in risk appetite and market narratives. Ĭrypto valuations are highly volatile, reflecting the absence of any intrinsic value. People like to gamble and investing in crypto offers them a way to do so. Understandably, many are now questioning the future of crypto-assets.īut the bursting of the bubble does not necessarily spell the end of crypto-assets. The altcoins’ names are abbreviated as follows: Bitcoin (BTC), Ether (ETH), Polkadot (DOT), Ripple (XRP), Cardano (ADA), Litecoin (LTC), Chainlink (LINK), Dogecoin (DOGE), Binance Coin (BNB), Bitcoin Cash (BCH), Uniswap (UNI), Solana (SOL). Notes: The data are for the period from 1 January 2015 to 15 June 2023 and are based on the price of crypto-assets as in the Crypto Coin Comparison Aggregated Index (CCCAGG) provided by CryptoCompare. An estimated three-quarters of bitcoin users suffered losses on their initial investments at this time. This caught millions of investors unprepared. The fall in the price of cryptos (Chart 1) led to a decrease of around €2 trillion worth of crypto assets within less than a year.

However, this illusion of crypto-assets serving as easy money and a robust store of value dissipated with the onset of the crypto winter in November 2021. Subsequently, the narrative of digital gold gained momentum, sparking a “crypto rush” that led to one in five adults in the United States and one in ten in Europe speculating on crypto, with a peak market capitalisation of €2.5 trillion. The vision of digital cash – of a decentralised payment infrastructure based on cryptography – went awry when blockchain networks became congested in 2017, resulting in soaring transaction fees. Since then, crypto has relied on constantly creating new narratives to attract new investors, revealing incompatible views of what crypto-assets are or ought to be.

#Crypto compare market caps software#

Some 15 years ago, software developers using the pseudonym Satoshi Nakamoto created the source code of what they thought could be decentralised digital cash. Speech by Fabio Panetta, Member of the Executive Board of the ECB, at a panel on the future of crypto at the 22nd BIS Annual Conference, 23 June 2023

0 kommentar(er)

0 kommentar(er)